Welcome!

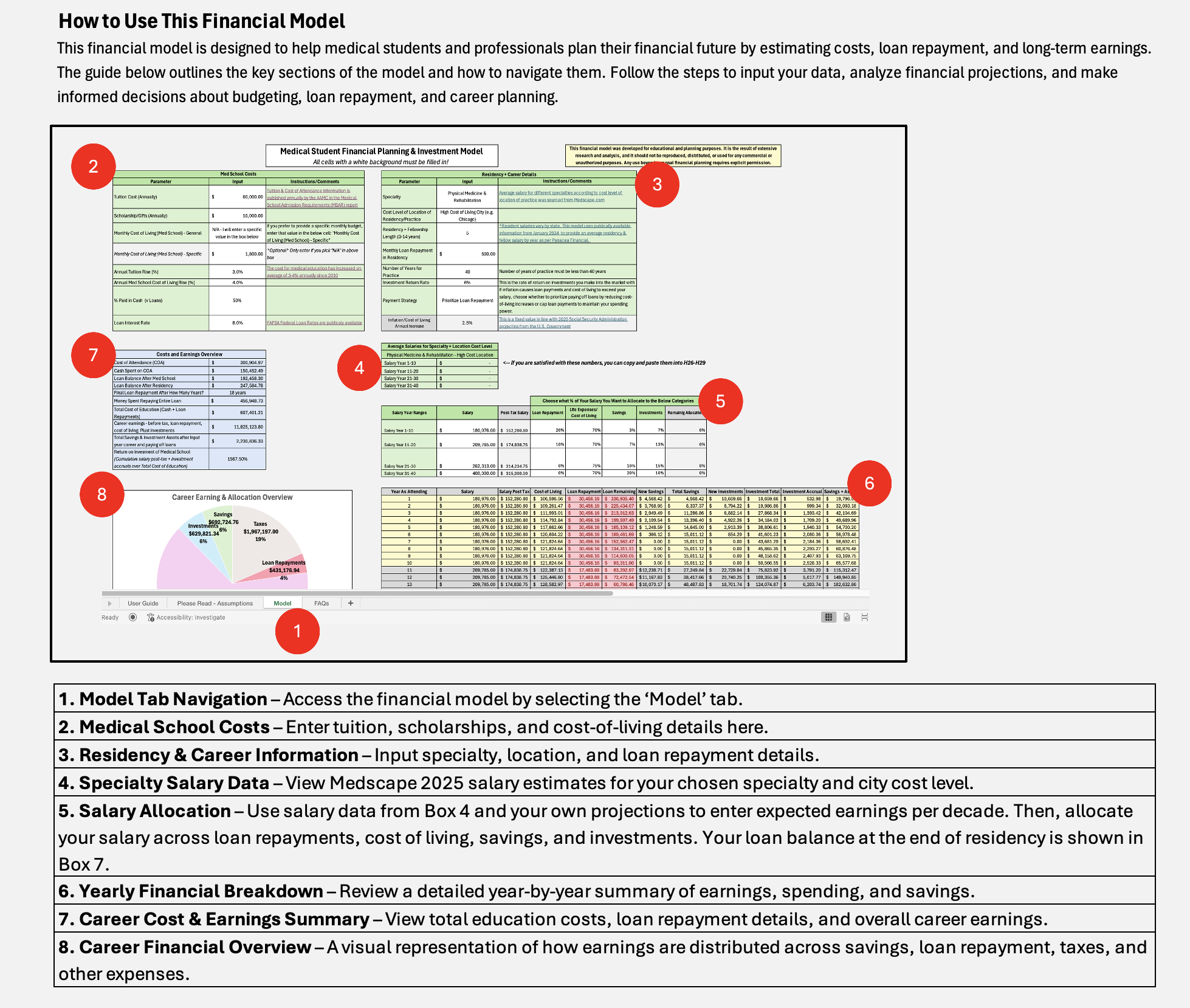

We built this financial model to help pre-med and medical students make informed decisions about their financial future. By inputting key variables, users can estimate the long-term impact of tuition costs, loan repayment, and projected earnings across different specialties and locations. The model dynamically adjusts for salary growth, inflation, tax brackets, and investment returns, allowing for a realistic forecast of financial outcomes.

Whether you're comparing medical schools based on projected debt or evaluating how lifestyle choices and career paths will affect your long-term savings and investments, this tool provides valuable insights to guide your planning.

Clicking the button below will download an excel file. We highly recommend using a desktop or laptop computer to run the file as neither this site nor the model has been optimized for mobile use.

Accurately projecting financial outcomes is incredibly complex, as real-world factors like market fluctuations, policy changes, and unexpected life events can significantly impact earnings and expenses. This model is solely illustrative, allowing students to edit and simulate different scenarios rather than serve as a precise prediction. It is built on key assumptions, which streamline calculations while maintaining flexibility for users to adjust based on personal expectations.

Model Assumptions

Medical School Costs

Cost of living during medical school is set as a monthly amount to reflect real-life budgeting. As an attending, cost of living is assumed as a percentage of post-tax salary following the 50/30/20 financial planning rule, which suggests 50% for essentials, 30% for discretionary spending, and 20% for savings/investments.

Loans accrue interest during medical school and residency, with an adjustable loan interest rate and annual tuition increases. Historic data is available to guide realistic input selection.

Public Service Loan Forgiveness is not considered.

Residency & Career

Residency is completed in the same state as future practice to maintain consistency in cost-of-living assumptions.

Resident salaries are fully allocated to loan repayment and cost of living, with no assumed savings or investments due to the low salaries, time constraints, and the possibility of loan forgiveness programs.

Salaries are based on available online data and adjusted by city cost level. Earnings are structured in 10-year increments for simplicity, rather than considering variable contracts or private practice fluctuations.

Salaries were collected as of 2025 and do not account for future inflation adjustments, meaning physicians reaching 31–40 years of practice in the future will likely earn more than the stated figures.

Long-Term Financial Planning

401(k) savings and employer benefits are not included in calculations.

Investments assume a fixed growth rate, despite real-world market volatility and fluctuations.

Inflation and cost-of-living increases are accounted for in a controlled manner, as the model projects salaries as fixed for each decade of practice. Without adjustments, inflation could cause cost-of-living expenses to exceed actual income over time. The model allows users to choose whether to prioritize loan repayment while capping cost-of-living increases or to cap loan payments and prioritize maintaining cost-of-living relative to income.

Savings and investments are allocated as percentages of post-tax salary and adjust only once per decade. While inflation increases annual cost of living, the model prioritizes relative ratio consistency to maintain accuracy.

Frequently Asked Questions

What is the purpose of this financial model?

This model helps medical students and professionals estimate the long-term financial impact of tuition, loan repayment, and career earnings. It allows users to simulate different scenarios and make informed decisions about budgeting, savings, and investments.

Where do I input my data?

Navigate to the "Model" tab and enter your medical school costs, expected salary, and financial allocations in the white input cells.

How are salaries determined in the model?

Salaries are based on 2025 Medscape physician salary data for different specialties and cost-of-living levels. However, these figures reflect earnings as of 2025 and do not account for future inflation or salary growth over time.

Does the model account for inflation?

The model assumes fixed salary brackets for each decade of practice, meaning inflation could impact cost-of-living assumptions over time. Users should consider adjusting salary estimates accordingly.

How are cost of living and loan repayment calculated?

Cost of living is set as a percentage of post-tax salary, following financial planning guidelines. Loan repayment is based on user inputs, with options to prioritize either loan repayment or cost-of-living expenses if total expenses exceed salary.

Can I include additional income sources or investments?

Yes, the model allows you to allocate portions of your income toward savings and investments, but it does not include employer benefits like 401(k) matching or alternative income sources. You may manually adjust inputs to reflect these factors.

Does the model assume Public Service Loan Forgiveness (PSLF)?

No, the model does not assume PSLF due to its variability in approval and qualification criteria. Users pursuing PSLF should manually adjust loan repayment assumptions.

What happens if my loan payments and cost of living exceed my salary?

The model allows you to choose whether to prioritize loan repayment and cap cost-of-living increases or cap loan payments and maintain cost-of-living expenses relative to income.

Can I customize the model for different career paths?

Yes! You can modify specialty, location, loan repayment strategy, and savings allocation to explore different financial scenarios.

Is this model a guarantee of financial outcomes?

No, this model is for illustrative and educational purposes only. It does not predict real-world outcomes, as salaries, market conditions, and expenses may change over time.